Faculty & Staff Giving

Deepen our culture of philanthropy by making an impactful contribution.

As a member of the Cumberland Family, you are one of the university’s greatest resources and most passionate supporters. Your generous giving creates a culture of philanthropy dedicated to student success that inspires our future alumni and friends of the university. Every day, you dedicate time and effort toward seeing your students succeed. Consider how your financial support can impact them even further.

How to Give

Payroll Deduction

Payroll deduction is a simple way to make your annual donation through installments weekly, monthly, or annually. You may edit your deduction at any time.

Planned Giving

If you are interested in future gifts to Cumberland University by way of your retirement plan assets, life insurance, or gifts through your will or revocable trust, please contact advancement@cumberland.edu or 615-547-1269.

Give Online

Online giving is an easy and quick way to make a contribution.

Give by Mail or by Phone

Checks can be dropped off at the Catron Alumni House, or may be directed to:

Cumberland University

1 Cumberland Square

Lebanon, TN 37087

Or give by phone by calling the Office of Advancement at 615-547-1269.

Frequently Asked Questions

-

Why is philanthropic support important to Cumberland University?

Because of our nonprofit status, Cumberland University relies on a combination of revenue and philanthropy to supply our budget. 99.7% of our students receive some form of financial aid, so it is vital for us to provide funding for these students so they can achieve their dream of earning a college degree. With the support of our Cumberland Family, we are able to fulfill our mission of preparing the next generation of leaders.

-

Can I designate my gift?

Yes. Just indicate on our giving or payroll deduction form where to direct your money — a specific school, athletic team, specific scholarship, facility improvement, etc. If you don’t have a preference, we encourage you to choose the Rise Together Annual Appeal. These gifts to Rise Together help support student resources, provide scholarships to deserving students, cover operating expenses, and much more.

-

How much should I contribute?

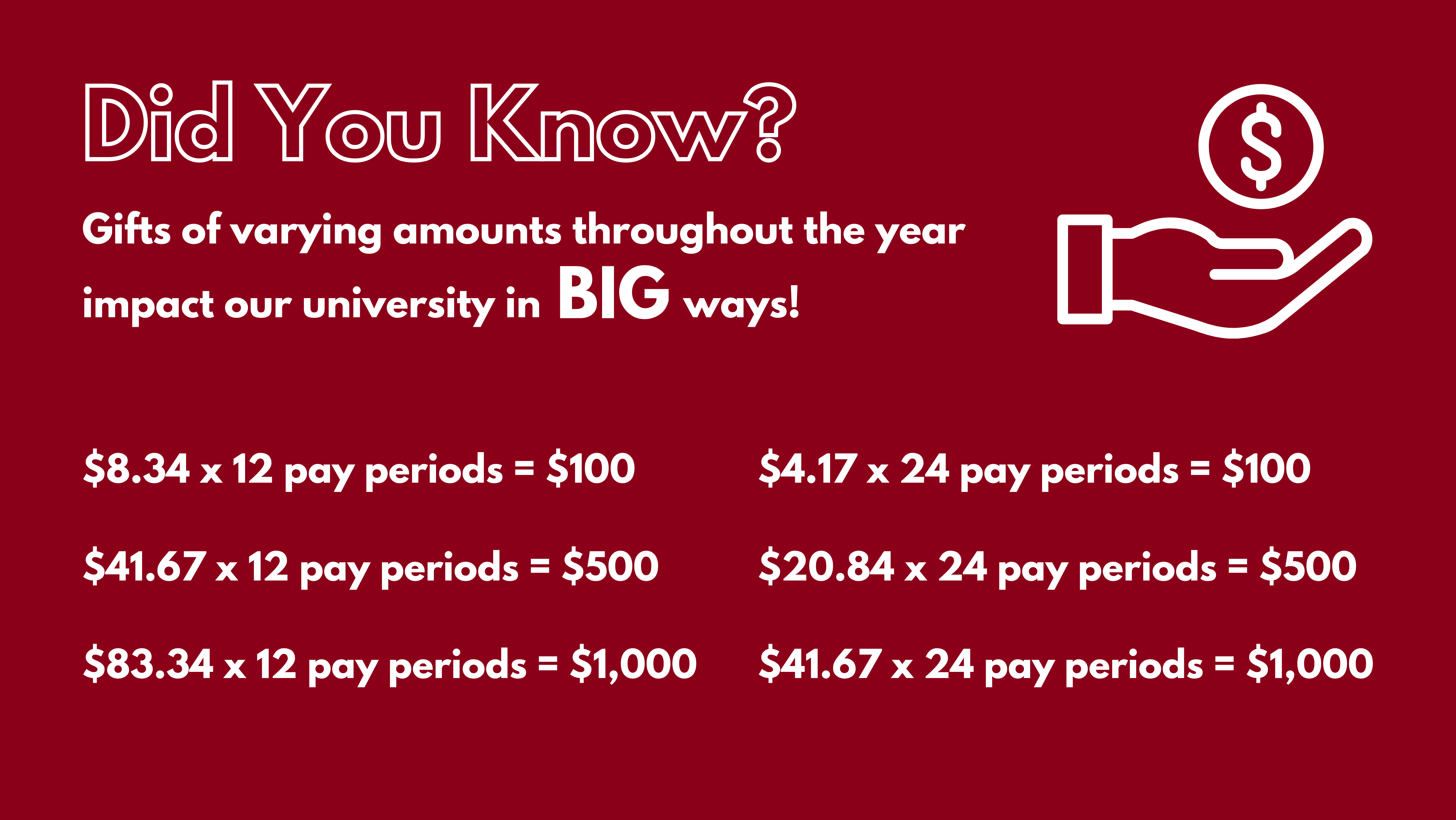

You determine the amount depending upon your own charitable priorities and capacity. Gifts of any size, including gift in-kinds*, count toward our participation rate and are appreciated at Cumberland University. High participation among faculty, staff, and administrators contribute to grant consideration and serves as a measure of institutional satisfaction to outside organizations.

-

What is a payroll deduction?

Payroll deduction is one of the easiest ways for faculty, staff, and administrators to make a gift to Cumberland University. You simply indicate the amount you would like automatically deducted from each paycheck, when you prefer it to begin, along with where your support should be designated and a few more details by completing the form here. Payroll deductions can be established as recurring or one-time.

-

What is a gift in kind?*

A gift in kind is a form of charitable giving where instead of giving money, the goods and/or services are provided by a third party. These types of charitable gifts also are important to Cumberland University and its future. For any questions regarding these forms of charitable giving, please contact (615) 547-1269 or advancement@cumberland.edu.